Bahrain embraces ‘open banking’ service requirements

TDT | Bahrain

The Daily Tribune - www.newsofbahrain.com

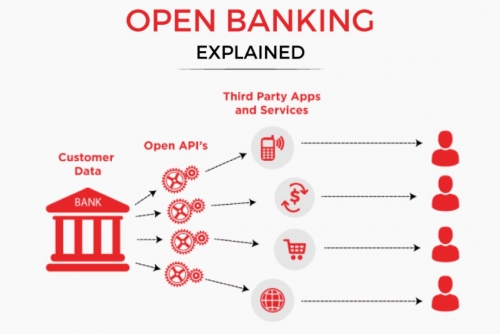

Starting 1 September, all licensed financial and banking institutions must adhere to “open banking” regulations, as announced by the Central Bank of Bahrain (CBB). These regulations include obtaining customer consent and authentication, licensee disclosures, and reporting on the performance of application programming interfaces (APIs) by service providers.

A recent circular issued by Khalid Humaidan, Governor of the CBB, outlined these requirements, obligating banks to provide information to payment service providers regarding legal entities after securing their consent.

The circular also introduced amendments to extend open banking services to legal entities such as institutions and companies. The amendments affect the General Requirements Module in the CBB’s Guidebook, Volumes 1 and 2, as well as the Open Banking Module in Volume 5, incorporating legal entities within the scope of open banking services.

Customer account data requirements

The circular specified that information and payment service providers must detail customer account data requirements for any use cases related to account information. It also introduced changes to the Reporting Requirements Module and the Public Disclosure Requirements Module within Volumes 1 and 2, concerning the disclosure of API performance by account service providers.

Guidance on business models for information and payment service providers will be included in the open banking module of the CBB’s Guidebook, Volume 5.

‘Integrated cash flow’

The circular also stipulated that Licensed banks must collaborate with Benefit Company to implement the “integrated cash flow” model for obtaining initial customer consent and authentication during the onboarding process.

Information and payment service providers are to agree with banks on standard API specifications and service standards, aligned with security guidelines under Bahrain’s Open Banking framework. These amendments follow consultations initiated by the CBB in March and October 2023, with an action plan from all licensed financial and banking institutions due by 30 June of the previous year.

Open banking is anticipated to stimulate Bahraini financial technology companies to develop new financial products and services, such as budgeting applications, personal loan offers, and investment platforms, leveraging open banking data.

Related Posts