Volatile economic milieu to delay IPOs in GCC

Initial public offering (IPO) plans by GCC companies might be postponed to a later period, until geopolitical and economic uncertainties are cleared, according to a recent report by KAMCO, a Kuwait based investment house.

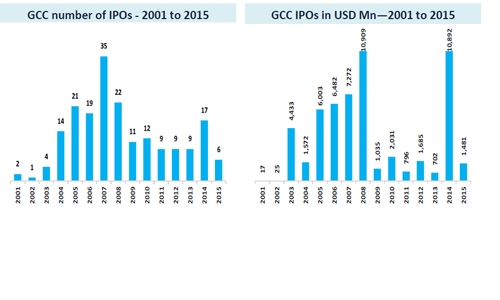

The expected drop in IPO activity in 2016 is on the back of lackluster IPO activity last year.

“The IPO space in the GCC for 2016 is likely to witness a slow start, as corporates would remain cautious about capital raising through primary markets and would look to gauge market appetite for their issuances. More corporates are likely to push their issuances to the back-half of 2016 or the outer years, until risk appetite returns to primary markets and uncertainties revolving around oil price, headwinds in the form of geopolitical risks and global economic growth concerns,” the report said.

It added, “The significant drop in oil prices that transpired during 2015, coupled with geopolitical concerns and global economic uncertainty weighed heavily on IPO issuances and equity markets.”

The slowdown in IPO issues in GCC was steeper than the global scene. “IPO trends receded in 2015, albeit at a slower pace compared to the GCC, as the number of IPO issuances fell by 2 pc to 1218 deals, while capital raised declined by 25 pc to USD 195.5 billion,” the report said.

Also, the region saw no IPO in the second half of last year, except one in Saudi by the end of the year.

Even though, the second half is normally affected by various holidays, the slowdown in listings was mostly ascribed to the negative sentiment prevalent in the market from falling oil prices, growing geopolitical concerns and broader economic uncertainty.

The 2015 activity was below the average number of listings observed during 2011-2013, a post-recession phase.

The report notes that Saudi Arabia continued to remain the dominant player in the region’s primary capital markets, notching up over USD 1bn through capital issuances and securing over half of the deals witnessed in the GCC.

Over 2001-15, Financial Services continued to remain the most active industry in the GCC at the IPO market with 66 deals. Industrial Manufacturing followed with 26 capital issuances followed by Oil & Gas (26) and Real Estate (16).

Cautious optimism is expected to prevail in 2016, as volatility, electoral uncertainty and the impact of geopolitical shocks are expected to have significant impact on the IPO market this year.

Related Posts