GCC can spruce up GDP through reforms

Manama : GCC countries can add a good 1.5 per cent to its GDP growth with a slew of reforms aimed at increasing productivity and having a better financial markets, according to a research published by IMF.

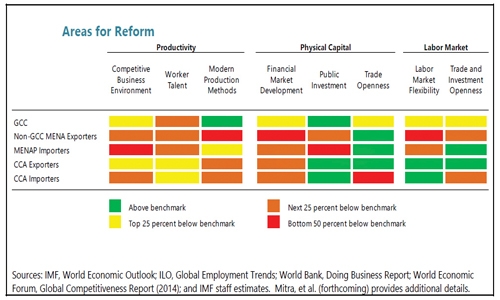

The study “Avoiding the new mediocre, raising long-term growth, in the Middle East and central Asia” says that The GCC could add 1.5 percentage points to its growth potential by closing gaps with advanced economies in having competitive business environment, developing more national talent and pushing more financial market reforms.

“A little more than half the gain, adding to current potential growth of 6pc, can come from boosting productivity growth through a more competitive business environment and developing the worker talent of nationals. The rest would depend on financial market development leading to the accumulation of higher physical capital in the private sector, complementing already high growth in public infrastructure.”

The study says that a more competitive business environment and financial market development would support higher growth in productivity and physical capital in the GCC. The GCC has generally achieved very high standards in almost all key reforms areas, having made marked improvements over the past few decades. But, the GCC still falls short of advanced economies in terms of evenhandedness of its business environment and the extent of financial market development.

This shortcoming has to be overcome by promoting a more competitive business environment through streamlining business regulations and reducing bureaucratic red tape to significantly lower the cost of doing business, raise the efficiency of government services, and foster innovation. “This would also be conducive to economic diversification and lowering the dependence of potential growth on oil-related activities, thereby raising the GCC’s economic resilience.”

Also, financial markets reforms should also be undertaken by the region, through better access to finance and legal rights.

The report bemoans the fact that in GCC bank loans are heavily concentrated around large borrowers and this prevents the growth of small and medium enterprises which are the main engines of job creation and growth in developed countries.

Also, more strengthening of credit information to enable lenders to properly assess the creditworthiness of borrowers and further development of alternatives to traditional bank finance were also suggested by the study. Regarding legal rights, the study says “modern international best practices are lacking in the GCC.”

It adds that decriminalizing bankruptcy is vital for the region as well as protection of minority shareholders and property transfer

registration.

More local talent needs to be developed and for this education system has to be better aligned with employment opportunities, the study suggests. “Over the long term, national worker talent needs to be developed. Less economic reliance on oil may adversely affect the GCC’s ability to hire talented foreign workers. Consequently, improving the quality of education of nationals today, where there is a substantial discrepancy between worker talent of foreign and domestic professionals, is critical for maintaining high levels of productivity into the future. In particular, better and more targeted education of nationals will support their participation in high value-added activities. To this end, the education system needs to be better aligned with the diversity of private sector needs.”

Related Posts