Businesses should start preparing for VAT: Experts

Manama : Businesses in the region should prepare themselves for a value added tax (VAT) regime and make necessary changes in their operations to ensure compliance; failure in VAT compliance could trigger penalties once VAT is introduced, according to experts.

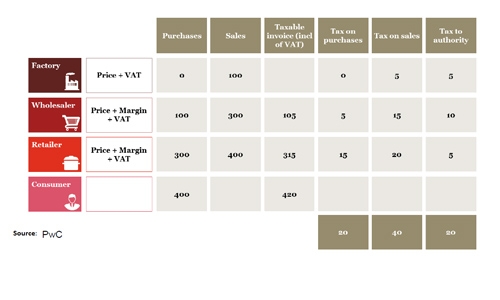

VAT is an indirect tax on consumption and it applies to most goods and services. VAT is levied on business transactions, i.e. on goods and services supplied in the course of business.

The Gulf Cooperation Council (GCC) States are expected to adopt a standard VAT system with a single rate applying to most goods and services and potentially some limited exceptions such as basic food items, healthcare and education.

The potential introduction of VAT in the GCC, as early as January 2018 in some GCC member states, will present a number challenges for businesses and individuals operating in these States, says PwC, a global tax advisory.

Five per cent is the expected standard rate of VAT and few exceptions may apply mainly driven by socio-economic policy considerations.

Also, in line with general VAT principles, exports of goods to countries outside the GCC territory will not be subject to VAT, but it will apply to goods imported into the GCC and this will be payable at the time and place of import says PwC.

Where a business is engaged in the supply of goods and services that are subject to VAT, tax incurred on costs can generally be deducted.

When a business is engaged in the supply of goods and services that are exempt VAT incurred on costs generally cannot be deducted, PwC adds.

Countries including Egypt, Jordan, Yemen, and Lebanon already have value added tax.

Jeanine Daou, PwC Middle East Partner and Indirect Taxes and Fiscal Policy Leader said during a recent VAT seminar in Bahrain said, “An understandable question we often receive is ‘what steps should be undertaken now, when the legislation is yet to be issued?’

Three good areas to focus on are 1) Modelling potential business impacts, 2) Understanding the IT systems and business processes that will be affected by VAT as part of shaping the VAT implementation project and 3) Review existing contracts that do not accommodate the introduction of a new tax. On the latter point, companies may be forced to absorb the impact of VAT if the contracts are not amended”.

According to Ken Healy, PwC Bahrain’s Tax Leader, “the implementation of VAT in the GCC is one of the most important challenges that business owners and CFOs in the region will have to face in the next five years. Having people with the right level of awareness and the right systems will save a considerable amount of time and resources for local and foreign companies operating in Bahrain and the GCC.”

Related Posts