Robots to play key role in investment management

Manama : Robots will increasingly play a major role in investment-management industry, but may not be able to fully replace human talent, at least in the short term, according to a majority of CFAs, a survey revealed.

The survey was conducted by the CFA Institute as a feedback for the recent discussion paper issued by the Joint Committee of the European Supervisory Authorities (European Banking Authority, European Insurance and Occupational Pensions Authority, and European Securities and Markets Authority) regarding the main characteristics of automated financial advice tools as well as their potential benefits, costs and risks. The survey was conducted globally including the members from the Middle East.

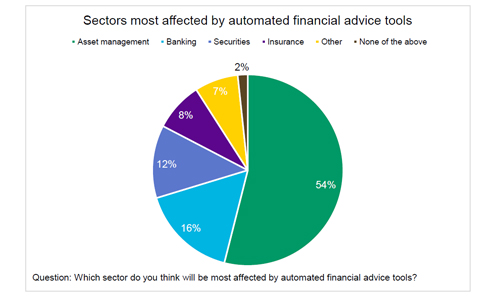

Among various sectors in the financial service industry, including banking, insurance, securities and asset management, the most affected will be the asset management industry, according to more than half of the survey respondents.

There is less chance of institutional investors and ultra high earners to be negatively or positively affected by automated financial advice tools, the survey says. CFA institute ascribe this to the thought that “the higher the wealth, the more likely that respondents do not think investors will be affected by automated financial advice tools, which are not yet capable of offering complex, tailored advice.”

“Most financial advice tools offer relatively unsophisticated advice based typically on offering a diversified portfolio. It is likely because of this stylised fact that 70 per cent of respondents think mass affluent investors will be positively affected by automated financial advice tools, followed by other investors (67pc) and high net worth individuals (41pc),” the report explains about the respondents expectation that robots will be able to give better experience to the mass.

But the cost borne by customers may come down with introduction of automated financial advice tools. “Our survey suggests that cost, access to advice, and product choice are likely to have a positive impact on consumers.”

The CFAs are not much worried about being replaced by robots. Even then, the mass segment will be more and more served by robots, the respondents believe.

Given the relatively unsophisticated nature of automated financial advice tools to-date, it is probably not surprising that respondents think it is unlikely that automated financial tools will replace engagement with human advisors for institutional investors and ultra-high net worth (HNW)investors. Both these groups typically require complex, tailored advice.

Respondents think these tools might replace HNW’s engagement with human advisors to an extent, but that mass affluent are most likely to experience automated tools replacing engagement with human advisors. These groups are most likely to benefit from relatively more straightforward diversification strategies.

Related Posts