Al Baraka Bank Sudan net profit doubles in Q1, 2016

Manama : Al Baraka Bank Sudan, a subsidiary banking unit of Al Baraka Banking Group B.S.C. (ABG), announced a large increase in its net profits in the first quarter of 2016, jumping by 196 per cent compared to the first quarter of previous year as a results of the bank’s success in diversifying its income sources from commissions, fees and financing, while financing and investments portfolio and deposits accounts maintained their end of the previous year’s levels.

The bank’s financial statements for the first quarter of 2016 shows that the total income achieved a big jump of 81pc to reach SDG76 million (US$12m). After deducting operating expenses, net operating income increased by 215pc to reach SDG44m (US$7m) in the first quarter of 2016 compared to the same period of 2015. After allocating for provisions and taxation, net income for the first quarter of 2016 increased to SGD33m (US$5m), doubling by 196pc compared to the first quarter of 2015.

On the balance sheet side, total assets of Al Baraka Bank Sudan stood at SGD2.3 billion (US$351m) as at the end of March 2016, an increase of 1pc compared to the end of 2015. Total financing and investments portfolio reached SGD1.24bn (US$193m) at the end of March 2016 slowing down by 9pc compared to the end of 2015. Customer accounts reached SGD1.6bn (US$245m) at the end of March 2016. The bank’s equity reached SGD292m (US$45m) at the end of March 2016, increasing by 1pc compared to the end of 2015.

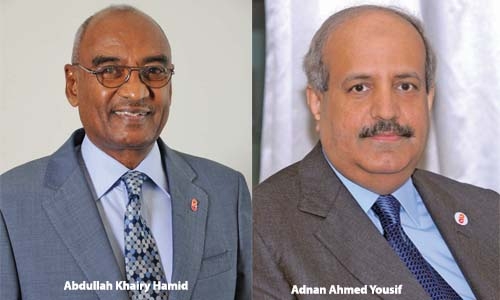

Adnan Ahmed Yousif, Chairman of Al Baraka Bank Sudan and President & Chief Executive of Al Baraka Banking Group said: “These results come on the back of the bank’s obtaining for the first time of credit rating beginning of this year from the Islamic International Rating Agency (IIRA), which has assigned the bank national scale investment grade credit ratings of A- (SD)/A-2 (SD) (A Minus/A Two), with “stable” outlook.”

For his part, Abdullah Khairy Hamid, the General Manager of Al Baraka Bank Sudan said, “The bank continued in 2016 to implement initiatives that will enhance its established and distinguished position in the Sudanese market, where the bank continued to upgrade its core banking system to incorporate electronic payment applications as a response to State initiatives to move towards ‘e-government’.

The bank also said it is planning to open a new branch in Khartoum Governorate, while progressing with plans for a new headquarters building in the capital. It anticipates adding one branch each year for the next five years, expanding the network to 31 by 2020.

Its ATM network was meanwhile expanded to 40 and will continue to grow in line with the increase in the branch network. The bank also said it will be formally launching its mobile banking service in 2016, in addition to introducing its new ‘Smart Account’ for university students.

Related Posts