Double-swiping of cards to be banned

Manama : The Central Bank of Bahrain (CBB) has asked all merchant establishments to stop double-swiping of their payment cards –- credit cards, debit cards, charge or prepaid cards etc -- at point-of-sale (POS) machines and cash registers from June 15.

“Merchant establishments swipe payment cards twice at POS machines or cash registers once a transaction is approved by the cardholder. This practice of double swiping is widely considered unsecure and hence, being discouraged by a number of countries,” the CBB said justifying the ban.

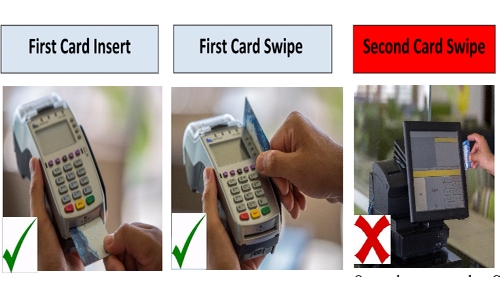

When a card is first inserted in to the acquirer at a sales counter, the card transaction is completed after the necessary approval or denial. The customer immediately receives a transaction advice via SMS message, for both, local as well as international card transactions. Accordingly, a card transaction does not require swiping the magnetic stripe again on the shopkeeper’s POS terminal or cash register.

“Merchants have double swiping as a practice over the years, to collect card payment details and cardholders’ personal data for internal accounting and/or marketing purposes. However, as this practice of swiping at a shopkeeper’s POS machine or cash register for the second time provides access to all payment card data, including sensitive information such as security code and personal data encoded on the magnetic stripe, it can effectively lead to card data compromise,” the CBB said.

“Capturing or storing such sensitive card information in a shopkeeper’s computer system, has the potential risk of unintentionally exposing such information to malpractices and card frauds,” the CBB said, adding it can undermine the efforts taken so far to enhance the security of card transactions by moving from magnetic stripes to EMV chip cards.

“There is a serious need to stop this unsecure practice of double swiping and thereby protect cardholder data against possible theft and to ensure public confidence in card transactions,” the CBB said.

CBB has taken several measures to protect card transactions over the years. Among these are the phasing out of the traditional magnetic stripe cards and adoption of the EMV (Europay, MasterCard and Visa International) compliant chip embedded cards, as far back as 2010.

Related Posts