The fiscal balancing act

As part of streamlining operational government expenses, Bahrain is forming six task forces to identify and implement a reduction in the government operations expenses.

They include Government building rents task force, ICT task force, Government building maintenance task force, Travel and transport task force, Medical resources task force as well as other operational expenditures task force. To ensuring hassle-free operation, the government has also developed a working mechanism to support the effective implementation of the fiscal balance programme which is expected to reduce the deficit by BHD 800 million annually over the coming years.

As per the mechanism, all purchase requests from the government entities will be submitted to a ministerial committee for financial affairs and rationalisation of expenditure, which will then be referred to a relevant task force for review. These requests will be then submitted to a Ministerial committee for approval with the recommendations of the task force. However, the committee reserves the right to approve or reject the purchase request based on the task forces recommendation filed to them.

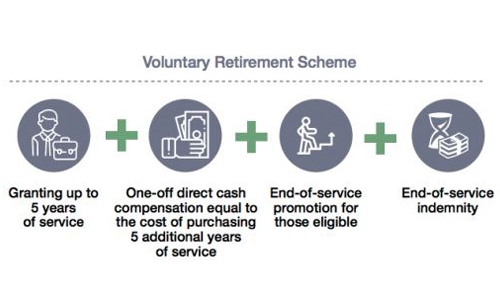

Besides, as part of the plan, the government has also announced a voluntary retirement scheme for government employees allowing them to retire early with full benefits and incentives. The move, according to the report, enables the employees to contribute to economic growth through entrepreneurship or participation in the private sector. To participate, the employees should satisfy certain eligibility criteria. Those applying for voluntary retirement should be full-time employees registered under the civil service bureau and should have at least 10 years of actual service.

The scheme, however, excludes senior position and requires that the employee shall not return to civil service after retirement. Those fulfilling the said criteria will be granted up to 5 years of series plus a one-off direct cash compensation equal to the cost of purchasing five additional years of service. The selected employee will also be eligible for end of service promotion and end of service indemnity.

Among the major steps that will be taken, the report confirms the implementation of the Value-added Tax in line with GCC agreements. The report states that a 5pc VAT will be applied to non-essential goods and services, in line with the GCC VAT Agreement.

Related Posts