Alert over VAT violations

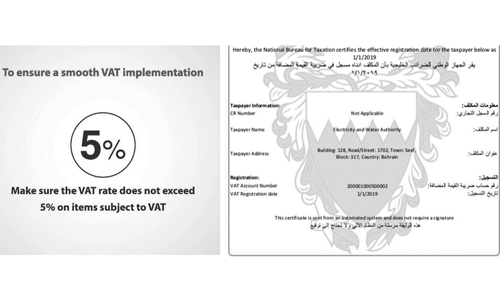

Consumers in the Kingdom have been urged to ensure that they don’t overpay for goods and services to businesses who may take advantage of the current confusion in the market and charge extra bucks for goods and services. Taking advantage of the existing confusion in the market, certain businesses may swindle the customers by charging extra and many customers are worried over being cheated in the name of VAT. The National Bureau of Taxation (NBT) has warned businesses against overcharging VAT and consumers to ensure they don’t pay in excess of 5 per cent for VAT.

“To ensure a smooth implementation of VAT, make sure that VAT rate does not exceed 5pc on items subjected to VAT,” the National Bureau of Taxation stated. It also urged customers to be vigilant. “Make sure VAT is not applied on items not subjected to the tax. To find the list of items not subjected to VAT, please visit our website www. nbt.gov.bh,” it highlighted. “To report any violations or complaints regarding the implementation of VAT, please call consumer protection on 80008001,” the NBT said, adding that consumers do not need to register for VAT.

The Industry, Commerce and Tourism Ministry has stressed that the teams of its general inspection centre and Consumer Protection Directorate will continue their inspection of commercial outlets and markets across the Kingdom to ensure the sound implementation of the Value Added Tax (VAT). The inspection teams aim to ensure that VAT is not levied on basic commodities and services that are exempted from it, the Ministry said, pledging deterrent measures against violators, including fines, closure or referral to the Public Prosecution, in line with the laws and regulations in force in the kingdom.

The Consumer Protection Directorate affirmed that the inspection campaigns would cover all outlets and sectors nationwide, calling on everyone to comply with the laws and regulations. Meanwhile, products being offered VAT free despite the legal requirements to impose the tax had become a topic of controversy in the past few days. According to widespread reports, various businesses marketed such VAT free offers on social media, creating a confusion in the market. However, Tribune has learnt that the stores bore the cost of VAT as a promotional offer rather than offering completely VAT free items.

“Many stores advertised that they are offering products completely free of VAT. This led to a confusion as many believed that the stores are avoiding VAT,” a source said. “Even though VAT amount may not be charged on customers, it is shown on their system and the tax is paid to the government by the business,” the source added. The NBT yesterday highlighted its ongoing efforts to enhance consumer protection and compliance with the VAT laws and its executive regulations in preparation for its induction on January 1, 2019.

The NBT has introduced various initiatives to enhance transparency and increase consumers’ awareness in regards to their rights. In this context, consumers are reminded that they are not required to register for VAT nor are they expected to go through the registration certificate procedures.

Related Posts