Major funding boost

Bahrain’s Ministry of Finance and National Economy yesterday said it has received the first instalment of a $10-billion financial support agreement ‘in full’ from key Gulf allies. The initial payment of $2.292bn for the year 2018 had been received “in full”, the ministry statement said. The statement further added that the “receipt of the second instalment of $2.276 billion for this year has already started.”

The economic reform plan, backed by the package from Saudi Arabia, the United Arab Emirates and Kuwait, was announced by the Kingdom in October 2018. As per the plan, Bahrain would receive instalments up until 2023. A Ministry of Finance spokesperson confirmed that as part of the support agreement, the government of Bahrain is set to receive further payments of $1.761 billion in 2020, $1.846bn in 2021, $1.421bn in 2022, and $650 million in 2023. The plan, Ministry says, was designed to save 800m Bahraini dinars ($2.1bn, 1.84bn euros) annually.

Deficit declines

The financial support agreement funds a substantial part of the financing needs of Bahrain’s Fiscal Balance Programme, a comprehensive plan put in place last year by the Kingdom, which has already led to the deficit falling by over a third. The reform programme includes cutting public expenditure and government waste, voluntary retirements for government workers and “redirecting” state subsidies.

The spokesperson added that the government successfully passed its national budget through the elected chamber of parliament. As part of the budget process, the government also reconfirmed its commitment to subsidy reform and that it would be implemented in coordination with parliament. As part of the $10 billion bailout deal, Bahrain agreed to introduce a 5 per cent value-added tax (VAT), as well as further subsidy cuts and a voluntary retirement plan for state workers.

Non-oil revenues

The authorities have said they are also looking to increase “non-oil revenues, to drive economic growth, diversify government income streams and align non-oil revenue with positive economic growth”.

“The fiscal balance programme introduced in 2018 aims to balance Bahrain’s budget by 2022 without diminishing basic services offered to citizens,” a report by Reuters said. The reports further said that the government is fast-tracking substantial infrastructure investment projects worth over $32bn, including $7.5bn from Gulf allies, $10bn from government holding companies and $15bn from private investors.

The fiscal programme has so far cut the budget deficit by 35 per cent according to preliminary estimates for 2018, it added.

Budget, a positive step

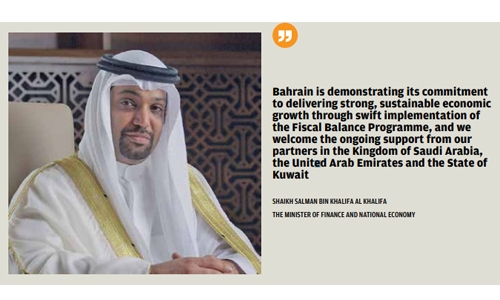

The Minister of Finance and National Economy, Shaikh Salman bin Khalifa Al Khalifa said: “The parliam e n t a r y vote on the National Budget is a further positive step in the significant progress we are making.” “The deficit is down over a third and annual GDP growth remains robust,” the Minister said.

“Bahrain is demonstrating its commitment to delivering strong, sustainable economic growth through swift implementation of the Fiscal Balance Programme, and we welcome the ongoing support from our partners in the Kingdom of Saudi Arabia, the United Arab Emirates and the State of Kuwait.”

Bond in second half

According to Bloomberg, Bahrain’s Eurobonds due 2028 have rallied this year, pushing the yield down about 1 percentage point to 6 per cent. The Bloomberg report also said: “Government officials are in talks with banks for a possible issuance in the second half of the year and have already met global investors in a non-deal roadshow.”

Related Posts