All expatriates will be covered by insurance according to the law

SEHATI for change

As per the law effective 1 December 2018, health insurance is mandatory for all, which requires beneficiaries to pay monthly contributions to a health insurance fund to access health services in public and private hospitals and health centres here.

Plans for the launch in 2019, however, was abandoned with the scheme now scheduled for mid-2020 launch. Upon launching, the government will be responsible for Bahraini contributions to the fund, while employers will finance those for expatriate residents.

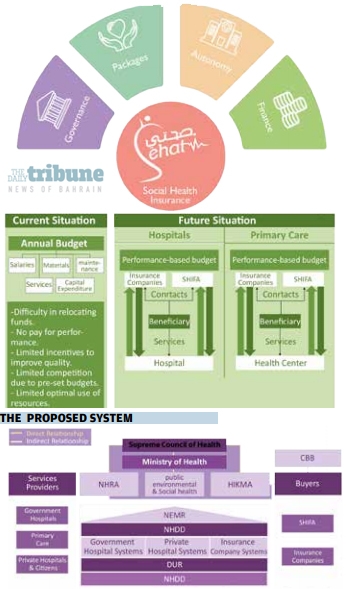

One of the main objectives of the National Health Plan (2016- 2025), which was endorsed by Cabinet, was the adoption of the Social Health Insurance Programme (SEHATI).

According to a handbook of the scheme “Road to Sehati” released by the Supreme Council of the Health in 2017, the programme is meant to revolutionise the local health sector through better utilisation of the available resources.

This would ultimately force public hospitals to compete with private hospitals in the quality of service provided to attract patients.

Who all need to sign up?

The handbook says residents, expatriates and their dependents are required to sign up for health packages, besides nationals. Insurance package for expatriate workers, which includes primary healthcare and emergency services, as well as secondary healthcare services upon referral by a family physician, is paid for by the employer.

Expats will have the right to sign up with private insurance companies if the packages thus offered includes all the services provided in the mandatory insurance package. Visitors to the Kingdom are also required to purchase this mandatory health insurance packages for the length of their stay in the Kingdom to cover accidents and other emergencies.

Bahrainis are allowed to seek certain medical services for free at government-owned facilities, while those choosing private sector hospitals or clinics have to pay up to 40 per cent of the cost with the government picking up the balance. GCC citizens, expatriates married to Bahrainis, as well as children of Bahraini mothers will receive the same benefits.

SHIFA

The current system based on a set central budget allocate to public hospitals and primary health care facilities will give way to a new system dubbed Social Health Insurance Fund Authority (SHIFA) when the new structure is launched. Premiums will be collected from beneficiaries by SHIFA, which in turn or private insurance companies will pay hospitals or health centres based on agreed contracts.

“The new system will also create a competitive environment between health providers, where the client (patient) will be given the freedom to choose between public hospitals (for mandatory health package for nationals recipients),” the guidebook says. According to a report by the International Medical Travel Journal, expatriate domestic workers, including housemaids, drivers, gardeners and nurses, will be covered for free under the scheme.

“105,000 domestic workers registered in Bahrain will be granted the same health privileges as Bahrainis, with no extra charge for their employers,” the report says. Other expatriates will have to contribute to their medical costs (excluding primary and limited secondary healthcare and emergencies) since they will enjoy only partial health cover, paid for by their employers.

Under the new system, each individuals will be paired to a family physician, who will provide preventive and therapeutic services. If specialist care is needed, then the patient is referred to a secondary healthcare hospital.

For Bahrainis

For nationals, the Mandatory Health Insurance is paid for by the government, which includes primary care (preventive and therapeutic), dental, emergency, governmental hospitals and overseas treatment. Citizens can also opt for an optional package which includes government funding and co-payment.

Nationals can also signup for private packages while remaining eligible for the mandatory package as a citizen. Benefits, co-payments, premiums, caps and service providers will be decided by the Insurance provider.

For residents

For residents/expatriates, employers will fund mandatory (primary, emergency) packages (cost-shared) for which there will be a cap for spending.

If exceeds, forthcoming premium is re-evaluated. Beneficiaries will have to pay a percentage of the yearly premium along with copayments on services. Private insurance companies and SHIFA will provide Insurance coverage.

Beneficiaries are entitled to approach any government and private facilities for treatment. Residents can also opt for optional packages where they have to act as a co-payer.

For visitors

For visitors, SHIFA will provide the coverage, while visitors themselves have to fund the mandatory package. Government facilities will provide health care.

However, if you are an expatriates and is not working here, you will have to pay for any medical treatment either out-of-pocket or thorough your health insurance provider.

Any health emergency that should arise and require immediate attention will not be provided by the public healthcare system.

Related Posts