Insurance sector on strong wicket

Driven by an increase in infrastructure projects and the implementation of mandatory third-party motor liability insurance in 2012 and medical insurance in 2013, the Bahraini insurance industry is continuing its healthy growth, according to a report by an investment bank.

The report by Alpen Capital says that the sector grew at an average annual-rate of 6.5 per cent from 2009 to 2013 and clocked 10 pc growth last year.

The report appreciated Bahrain’s efforts to boost the insurance sector and added, “Bahrain exhibited the highest insurance penetration rate in the GCC at 2.1 pc in 2013, resulting from a comparatively long insurance industry history and clear regulations. Several international entities have set up their branch in Bahrain due to its regulatory regime that allows free movement of capital and 100pc foreign ownership, besides the availability of a highly skilled workforce.”

The investment bank added that overall insurance penetration in the GCC might improve from 1.4 pc in 2014 to 3.3 pc in 2020. “By 2020, insurance density in the GCC nations is anticipated to triple from its 2014 levels, as more individuals and businesses seek insurance cover to meet the requirements by law,” it added.

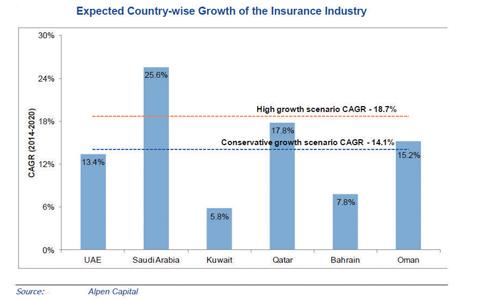

The industry is estimated to reach a size of $62.1 billion by 2020, growing at a compounded annual rate of 18.7 pc from 2014. However, the oil prices may hinder this growth level, according to the report. On a conservative estimate basis, the report noted, the industry might be able to reach only $49bn by 2020, still clocking a healthy growth rate of 14.1 pc per annum.

The growth drivers for the region’s insurance sector growth are growing young population in GCC countries, stable GDPs, regulatory reforms, increasing demand for medical insurance, growth of Takaful insurance backed by the positive outlook for the global Islamic banking and finance sector, and the insurance requirements for the rapidly growing SME sector in the region.

Related Posts