Nearly 19,000 VAT payers in Bahrain, new statistics

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

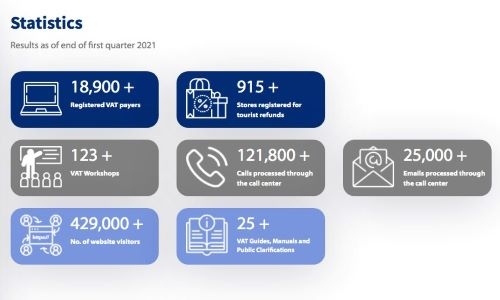

There are over 18,900 registered Value Added Taxpayers in the Kingdom, according to official statistics.

The statistics by the National Bureau of Revenue is for the first quarter of 2021.

The bureau also said that it held more than 123 workshops and processed 121,800 calls and 25,000 emails through its call centre during the quarter.

The website of the bureau also had over 429,000 visitors during the first quarter of 2021.

The bureau, during the quarter, also published more than 25 VAT Guides, Manuals and Public clarifications.

The National Bureau for Revenue was established by Royal decree (45) of the year 2018 and amended by decree no (9) of 2019.

The bureau affiliated with the Minister of Finance and National Economy handles the registration of entities and individuals subject to VAT and Excise.

The bureau had also published a list of excise goods in the Kingdom. The list has 9051 products ranging from Pepsi Wild Cherry 355ml to Sams Vapes Sample Salt Nicotine 30ml.

Excise, according to NBR, is implemented on specific harmful goods to encourage reducing the consumption of these goods, as agreed by the Gulf Cooperation Council on 16 November 2016. Accordingly, a 100% excise rate is applicable on Tobacco and its derivatives, Carbonated and Energy drinks.

The decision is according to law No. (39) for the year (2017) ratifying the Common Excise Tax Agreement of the States of the Gulf Cooperation Council. On the other hand, VAT or Value Added Tax for goods and services bought and sold by businesses.

A VAT of 5% was launched in Bahrain on 1 January 2019 as agreed by GCC countries on 6 October 2018. Meaning, when purchasing selected goods or services, consumers pay the VAT cost.

In turn, businesses pay the NBR the VAT collected from their customers’ purchases and recovers the VAT they paid to their suppliers. In Bahrain, VAT does not apply to a range of food products like water, milk, meat, fish, oils, egg, sugar, salt, infant formula, bread products, vegetables, fruits, coffee beans, tea, cardamon, wheat and rice.

Related Posts