Lessons we refuse to learn

Manama : Countries in the receiving end of oil-price shocks are yet to learn from their past lessons; “Fiscal policy in resource-rich countries tends to be highly procyclical and more so than for other economies,” according to a recently released IMF working paper.

The study covers more than 48 countries where the share of oil, gas and metals in the total exports are at least 20 per cent.

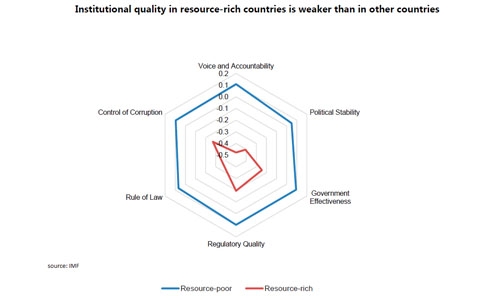

The working paper titled “Macroeconomic Stability in Resource-Rich Countries: The Role of Fiscal Policy” suggests efforts to improve institutional framework, enhancing transparency and accountability and political institutions to change the trend of overspending at times of commodity price boom.

“More efforts are needed to establish a comprehensive fiscal policy framework in resource-rich countries that can help cope with heightened uncertainty and volatility. These frameworks should be based on a solid long-term anchor to guide fiscal policy and should explicitly incorporate commodity price uncertainty. This means putting more emphasis on building precautionary savings during good times to help weather shocks in a countercyclical fashion.”

“Next, further efforts to improve the institutional framework are needed, including enhancing transparency and accountability. Tax policies aimed at diversifying the revenue base would reduce government’s overdependence on commodity revenues and improve its ability to run countercyclical policies. Finally, efforts to diversify the economy beyond the commodity sector are also critical.”

Quality of political institutions helps limit the spending excess during high prices, the study notes.” Procyclicality would be eliminated in countries with the degree of bureaucratic quality or quality of institutional and legal setting around two standard deviations above the mean.”

Some countries have been successful in limiting the negative impact of the commodity prices volatility and promote sustainable economic growth. Namely, the quality of institutions in Norway, Chile, and Botswana is higher than among their peers, which helped support fiscal policy and achieve stronger and higher long-term growth, the study says.

GCC nations are considering the introduction of Value added taxes and talks are in advanced stages among them.

IMF Managing Director Christine Lagarde had recently said that GCC countries need to strengthen their fiscal framework and reengineer their tax systems. UAE has announced VAT introduction by 2018 and other GCC countries are expected to follow suit.

Related Posts