India struggles to soothe markets as liquidity concerns grow

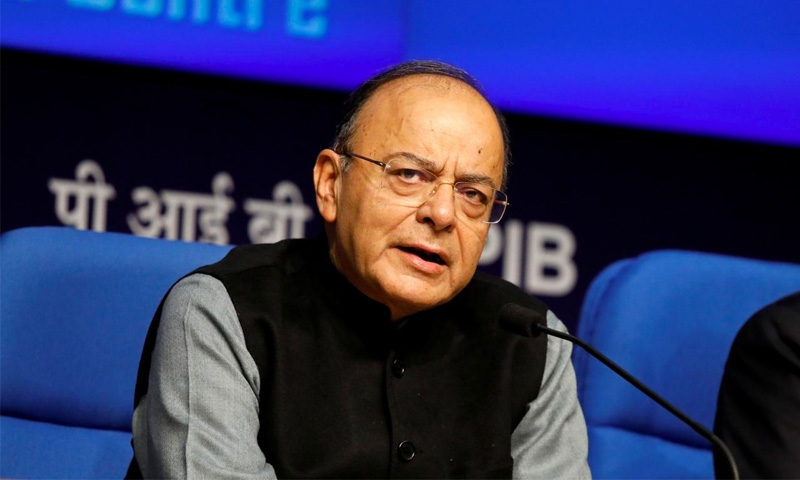

Mumbai : Indian authorities sought to calm financial markets on Monday but investors paid little heed as fears that the nation’s non-banking financial sector is facing a credit crunch led to declines in domestic bonds, stocks and the rupee, adding to losses suffered in a selloff on Friday. Finance Minister Arun Jaitley made the boldest official pledge yet when he tweeted that “the Government will take all measures to ensure that adequate liquidity is maintained/provided to the NBFCs,” in reference to the non-banking financial companies.

His intervention came on the heels of assurances on Sunday from both the central bank, the Reserve Bank of India, and market regulator, the Securities and Exchange Board of India, that they were closely monitoring developments in financial markets and ready to act if needed. However, the benchmark Nifty Index closed 1.58 percent lower on Monday, while the benchmark 10-year bond yield was up 2 basis points at 8.10 percent as bond prices dipped. On Friday, the stock index at one stage plunged more than 3 percent in a 30-minute period.

The partially convertible rupee was weaker at 72.54 per dollar versus its previous close at 72.1950 and not far off its record low of 72.99 hit early last week. Investors have been unnerved by credit concerns surrounding two companies in particular. One of the biggest NBFC names in India - Infrastructure Leasing & Financial Services (IL&FS) - this month defaulted on a series of its coupon payments. Then on Friday, a large fund manager sold short-term bonds issued by home loan provider Dewan Housing Finance at a sharp discount, raising fears of wider liquidity problems in the sector.

“The recent tightness of liquidity in the corporate bond markets indicate a contagion effect may be playing out following the default by IL&FS,” said brokerage firm CLSA in a research note on Monday. A big correction in equity markets could hurt Prime Minister Narendra Modi and the ruling Bharatiya Janata Party (BJP) as they prepare for a series of key state elections later this year and a general election by the month of May 2019.

Related Posts