We move together with VAT

The Kingdom plans to introduce Value Added Tax (VAT), a broadbased indirect tax levied on the consumption of goods and services, from January 1, 2019 at a standard rate of 5 per cent. Few items of goods and services are either ‘zero-rated’ or ‘exempt. Certain Zero-rated items and Exemptions will be subject to satisfying conditions and procedures to be outlined in the Regulations. The VAT Law states that detailed Regulations are expected to be issued within 15 days after the effective date of VAT.

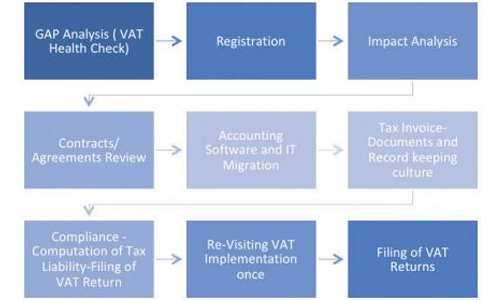

STEP BY STEP GUIDE

VAT Framework involve understanding local legislation, its implementation and compliance. Below diagram depicts the key steps in implementation of VAT regulations in one’s organization: As outlined in the diagram above, all businesses may need to conduct a VAT Health Check, to determine key areas of focus for implementation. This also enables the businesses to decide on group v/s standalone registration.

As outlined in VAT law, all businesses need to register for VAT with tax bureau if they meet the mandatory registration threshold criteria i.e. $100,000 of taxable supply (or its equivalent in the GCC State currencies) or as in special cases. Out of all these Steps, Impact Assessment and Transitional issues assumes greatest importance considering the unique position of Bahrain economy with regard to its first tryst with Tax System.

This must be managed well so that introduction of VAT has minimal or no effect at all on the cost of doing business. Transitional Issues may relate to the areas of VAT Framework, Human Resources, IT, Procurement, Vendor, Market Share, Legal & Commercial Structure among others. Another important area for businesses to review shall be migration to new IT system or modification to existing one including VAT Reporting requirements.

One may also focus on Procurement, Vendor selection and Market Share as they play an inter-dependent role to keep the entity on the same footing even under VAT regime. This is where the maximum impact of VAT is felt in terms of cost, pricing and working capital requirements. In a nutshell, VAT is not a cost to businesses but an opportunity to streamline their business processes and implement sound organizational principles.

During this transitional phase, communication, both internal (with employees and vendors) as well as external (with customers and stakeholders) shall help organizations to enhance the effectiveness of implementation process.

PLAN FORWARD

The introduction of VAT in Bahrain may have an impact on how ones does business in Bahrain. Businesses may require considerable effort, having been used to tax-free environment, to update their processes, systems, contracts, people and stakeholders for VAT. As the expected implementation date of 1 January 2019, does not leave much room for businesses to prepare for VAT, it is important for businesses to initiate their VAT preparations immediately.

They have 60 days in hand and with strong implementation plan, one can successfully implement the new VAT regime. We at AJMS have the experience of implementing VAT for numerous companies, across various industry sectors, both in UAE and KSA.

ABOUT AJMS (WWW. AJMSGLOBAL.COM)

AJMS is a niche Tax, Risk & Compliance consulting firm comprising of Chartered Accountants and Management Consultants. The team of professionals and consultants employed by the firm are drawn from diverse sectors of the industry and offer professional assurance / advisory services and have hands on experience in implementation of Indirect Tax regime for various organizations in GCC.

PILLARS OF VAT

The key pillars of VAT have been outlined above:

Related Posts