Sukuk Issuance to go up

Manama

----

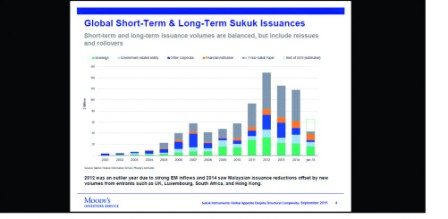

Sukuk issuance is expected to reach new highs in the coming years as more issuances are expected from GCC countries, especially Saudi Arabia. Even though, issuance from Malaysia has been on a decline, new entrants like UK, Luxembourg, South Africa and Hong Kong have arrested the volume decline, according to analysts.

The International Islamic Liquidity Management Corporation, started recently, a multi-country initiative, is expected to play a leading role in developing the secondary markets Islamic Sukuks. Unlike, modern finance, Islamic Finance lacks a liquid secondary-market where people could buy and sell Islamic finance products without much hassles, the Moody’s analysts Nitish Bhojnagarwala and Khalid Howladar told DT News recently.

Unlike, Malaysia, which is cutting down its debt, Saudi Arabia is in a very good economic situation to increase its debt and it is expected that they will issue more Islamic debt. This, coupled with the efforts of the International Islamic Liquidity Management Corporation will lead to a better liquidity situation for Sukuks market, they added.

The recent initiative from Bahrain in starting a Central Sharia Board was lauded by the analysts and added that it will cut down many uncertainties involving standardization of Islamic products.

Nitish added that Islamic-assets analysis is also based on the process followed for other asset types and added that Sharia compliance generally ‘does not’ drive credit risk.

Related Posts