US Fed to continue cutting as fears

White-hot panic about global trade may have eased a bit in recent weeks but the economic outlook is no easier to call for the US Federal Reserve as it prepares for a meeting on interest rates this week. While the United States and China declared another truce and odds fell that Britain will crash out of the European Union, any improvements are as liable to be suddenly dashed as lead to success.

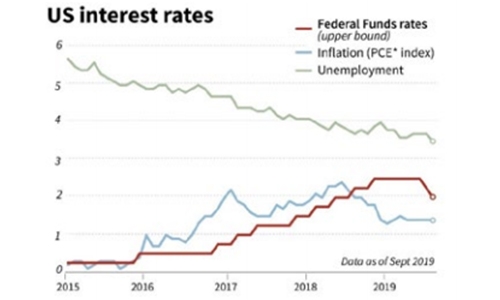

Amid the uncertainty, Fed policymakers appear ready to approve the third interest rate cut in a row as they grow more worried about the future, some daring even to use the dreaded word “recession.” Fed Chairman Jerome Powell this month reiterated his pledge to do what it takes to keep the US economy afloat. And his number two, Vice Chairman Richard Clarida, in a recent speech pointed to global growth estimates that “continue to be marked down.”

And while some economists question whether another move would be necessary or effective, the two-day meeting Tuesday and Wednesday is held amid increasing signs central bankers are on edge. In a London speech, James Bullard, the St. Louis Fed’s aggressively dovish president, displayed a forecast chart bathed in red, reflecting more downward revisions to the growth projections for the United States, the euro area, Britain and China.

“The key risk is that this slowing may be sharper than anticipated,” he told a conference of central bankers. And minutes of the Fed’s policy meeting last month said a “clearer picture” is emerging of how the trade war could drive the United States into a downturn. Lost export markets, weak demand and uncertainty could lead to a drawn-out slump in business investment, threatening hiring, consumer spending and the wider economy, according to the meeting’s minutes.

That cautious sentiment is apparent in comments from many American businesses in the Fed’s “beige book” report, and corporate earnings this month have confirmed it: Ford, Boeing, Caterpillar and 3M have all said revenues suffered from falling sales in China. The result: Futures markets overwhelmingly predict Powell will announce another cut in the benchmark borrowing rate on Wednesday in light of the darkening economic picture.

Related Posts