Batelco achieves H1 2021 net profit attributable to equity holders of BD37.5 million, a 5 per cent YoY increase

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

Batelco today announced its financial results for the second quarter of 2021, the three months ended 30 June 2021 (Q2), and for the first six months of 2021 (H1), the period ended 30 June 2021.

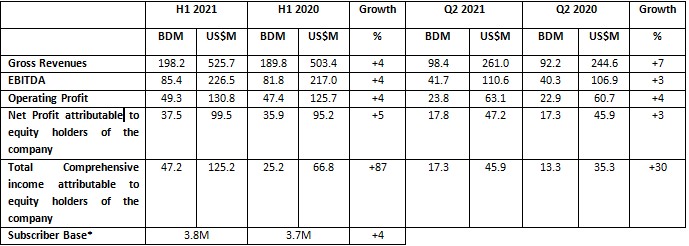

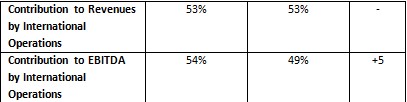

For the second quarter of 2021, the three months ended 30 June 2021 (Q2), Batelco reported a 3% increase in net profit attributable to equity holders of the company of BD17.8M (US$47.2M) compared to BD17.3M (US$45.9M) for Q2 2020. Likewise, net profits attributable to equity holders of the company for H1 2021 of BD37.5M (US$99.5M) increased by 5% from BD35.9M (US$95.2M) for the corresponding period of 2020. The increase in net profit is mainly attributable to steady increases in revenues for the first six months of the year. Earnings per share (EPS) are 10.7 fils for the second quarter of 2021 compared to 10.4 fils in Q2 2020 resulting in an EPS of 22.7 fils for the period compared to an EPS of 21.7 for H1 2020.

Total comprehensive income attributable to equity holders for Q2 2021 was reported at BD17.3M (US$45.9M), an increase of 30% from BD13.3M (US$35.3M) for the second quarter of 2020. Total comprehensive income attributable to equity holders of the company for the first half of 2021 is up by 87% from BD25.2M (US$66.8M) in H1 2020 to BD47.2M (US$125.2M) in H1 2021.

Revenues for the second quarter in 2021 of BD98.4M (US$261.0M) increased by 7% compared to BD92.2M (US$244.6M) in Q2 2020. Similarly, revenues for H1 2021 were BD198.2M (US$525.7M), an increase of 4% when compared to BD189.8M (US$503.4M) of revenues in H1 2020. The increase in revenues is mainly due to YoY increases in fixed broadband, adjacent services and wholesale revenues of 18%, 16% and 5% respectively.

Operating profit for Q2 2021 is up by 4% to BD23.8M (US$63.1M) from BD22.9M (US$60.7M) in Q2 2020; while year-on-year operating profits increased by 4% from BD47.4M (US$125.7M) in H1 2020 to BD49.3M (US$130.8M) in H1 2021.

EBITDA stands at BD41.7M (US$110.6M) in Q2 2021 compared to BD40.3M (US$106.9M) in Q2 2020, an increase of 3%. For the first half of 2021, EBITDA increased by 4% from BD81.8M (US$217.0M) in H1 2020 to BD85.4M (US$226.5M) in H1 2021, with a healthy EBITDA margin of 43%.

Batelco’s balance sheet remains strong with total equity attributable to equity holders of the company of BD487.9M (US$1,294.2M) as of 30 June 2021, 3% higher than BD473.2M (US$1,255.2M) reported as of 31 December 2020. Total assets of BD1,007.4M (US$2,672.1M) as of 30 June 2021 have increased by 2% compared to total assets of BD992.2M (US$2,631.8M) as of 31 December 2020. Net assets as of 30 June 2021 which stand at BD526.5M (US$1,396.6M) are 3% higher than BD512.1M (US$1,358.4M) reported as of 31 December 2020. The Company’s cash and bank balances are a substantial BD196.4M (US$521.0M), which reflects the 2020 final dividend of 16.5 fils per share paid in April 2021.

The Board of Directors approved an interim cash dividend for shareholders of 13.5 fils per share or 13.5% of paid-up capital for the six-month period of 2021. This is in line with the 2020 interim dividend payment and the Board of Directors commitment to continuously deliver strong returns to shareholders.

Financial and Operational Highlights

Commenting on Batelco’s performance for the first half of 2021, Batelco Chairman, Shaikh Abdulla bin Khalifa Al Khalifa said, “Batelco’s Board is pleased with the Company’s performance for the first half of the year.

Following a positive start to the year, we are glad to maintain the momentum, which is reflected in our financial results for the second quarter. Batelco achieved a 4% increase in revenues, contributing to a 4% increase in EBITDA and 5% increase in net profit for the six months ended June 2021. We appreciate the efforts of the executive team for their diligent management and commitment to implementing the strategic objectives.”

“Delivering strong returns for Batelco’s shareholders is a priority for the Board of Directors and accordingly, we are glad to note an increase in Earnings Per Share (EPS) of 22.7 fils for the six month period, up from 21.7 fils in H1 2020,” the Chairman added.

“We’re proud of being the first telecom company in the GCC to receive a license for Open Banking, with the establishment of Batelco’s new licensed company, Batelco Financial Services. This step reflects the Board’s aspirations to advance steadily towards digital transformation while enhancing and growing Batelco’s core business,” the Chairman continued.

Shaikh Abdulla concluded, “Investments in growing our digital portfolio is in line with international trends and continues to be an important step in our strategic plans to ensure that Batelco is in a position to be a key player in the growth of Bahrain’s digital economy."

Speaking following the announcement of the Half-Year financials, Batelco CEO Mikkel Vinter said, “We are proud of the strong financial results for the first six months of 2021, which are supported by year-on-year increases in fixed broadband, adjacent services and wholesale revenues.”

“It’s been rewarding to make good progress in converting key strategic plans in the digital space into actions, including the successful roll-out of key projects such as the launch of Batelco Financial Services, to provide both consumers and SMEs with a broad range of financial related services such as digital wallet creation and cards issuance services.”

“During the first half of 2021, Batelco focussed on delivering exceptional speeds and innovative products for the enterprise, consumer, and global business sectors. Key achievements included introducing new 5G Mobile Broadband packages to deliver speeds six times faster than 4G, and redesigned Home Fiber Broadband packages with speeds as high as 1Gbps.

“The development of Batelco’s Data Centres remains high on the agenda and in line with world-class standards in Data security, our teams worked hard to achieve PCI DSS ‘Payment Card Industry Data Security Standard’ compliance, for Batelco’s three Data Centers, thus ensuring a reliable and highly secure data storage environment for our customers.”

“The successes of the second quarter reflect the dedicated efforts of the entire Batelco team who worked together to achieve the desired results. I am grateful to each team member and encourage them to keep up the positive momentum to execute our ambitious business plans for the second half of 2021,” Mr. Vinter concluded.

Related Posts