Total fintech investment tops US$210 bn, as interest in crypto and blockchain surges

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

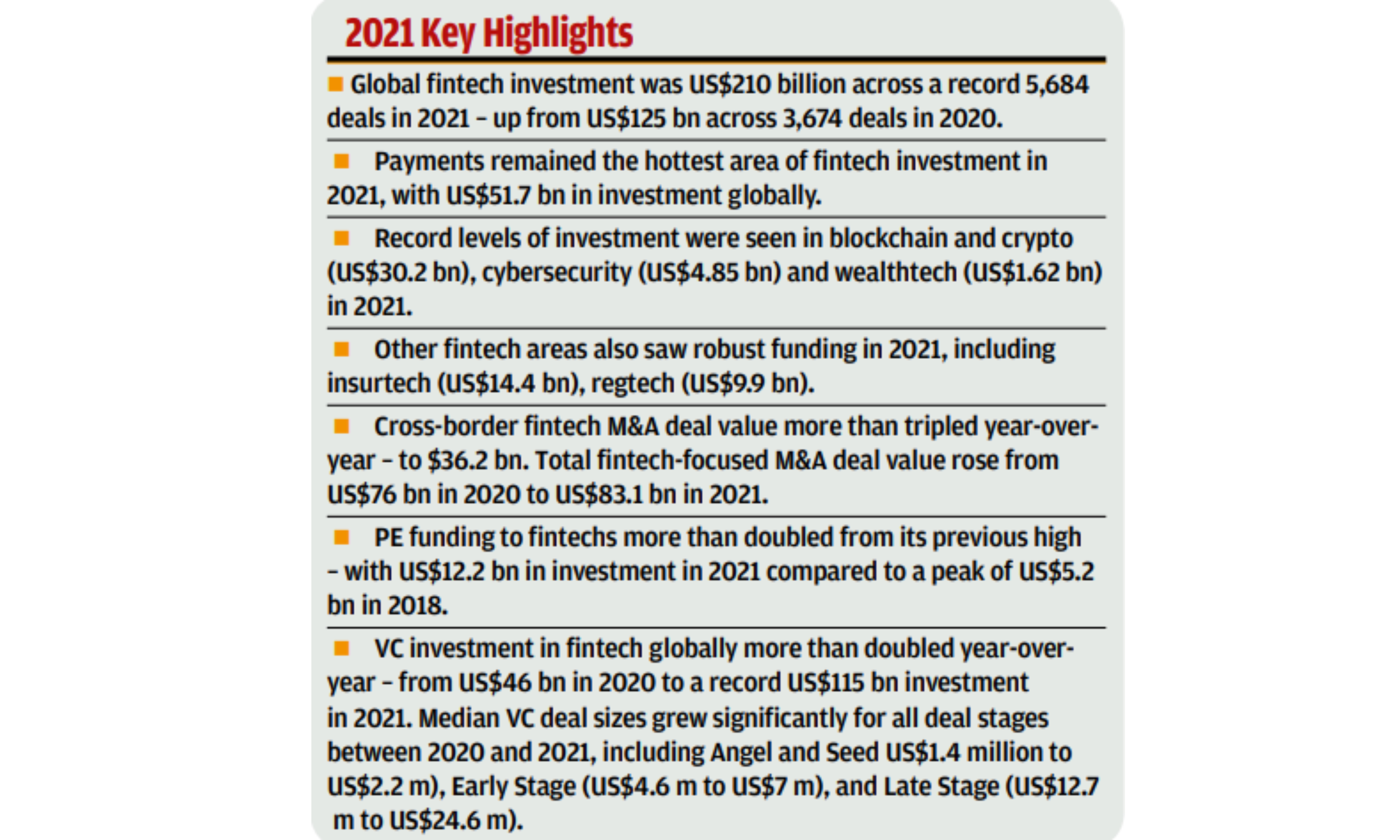

According to the Pulse of Fintech H2’21 – a bi-annual report published by KPMG highlighting global fintech investment trends – total global fintech funding across M&A, PE and VC reached US$210 billion across a record 5,684 deals in 2021.

Fintech funding in H2’21 accounted for US$101 bn of this total – down slightly next to H1’21’s US$109 bn.

“2021 has been an incredibly strong year for the fintech market globally, with the number of deals soaring to record highs across the board,” said Anton Ruddenklau, Global Fintech Leader, KPMG International. “We’re seeing an incredible amount of interest in all manner of fintech companies, with record funding in areas like blockchain and crypto, cybersecurity, and wealth tech.

While payments remain a significant driver of fintech activity, the sector is broadening every day.”

Payments continued to attract the most funding among fintech subsectors, accounting for US$51.7 bn in investment globally in 2021 – up from $29.1 bn in 2020.

A continued surge in interest in areas like ‘buy now, pay later, embedded banking and open banking aligned solutions have helped keep the payments space very robust.

Blockchain and crypto was also a very hot sector, attracting a record US$30.2 bn in investment – up from US$5.5 bn in 2020 and more than three times the previous record of US$8.2 bn seen in 2018.

Cybersecurity (US$4.85 bn) and Wealthtech (US$1.62 bn) also saw record levels of investment. Manav Prakash, Advisory Partner at KPMG in Bahrain, added “We are seeing increased momentum in the Fintech space in Bahrain with leading Fintech players evaluating Bahrain as their regional hub and scouting for partnerships in the local market with traditional players.

Payments specifically is an area where we see a lot of emerging interest and use cases.

Our view is that we are going to see a lot more innovative players establishing their presence in Bahrain in the short term and some game-changing partnerships emerging.”

After falling to a seven-year low of US$10.7 bn in 2020, cross-border fintech M&A deal value more than tripled year over year to US$36.2 bn in 2021.

Heading into 2022, fintech investment is expected to remain very robust, with activity growing in less developed fintech markets, including Africa, Southeast Asia, and Latin America.

“Cryptocurrencies and blockchain are expected to remain very hot areas of investment in 2022, with more crypto firms looking to regulators to provide clear guidance on activities to help foster and develop the space,” said Anton Ruddenklau, Global Fintech Leader, KPMG International.

“Given how many banks are beginning to see the major limitations inherent in their legacy architecture and technologies, there will likely also be a surge in investment into banking replacements able to help them rethink core banking services.”

Related Posts