Alba’s Q4, full-year profits surge on higher LME prices

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

Aluminium Bahrain (Alba) yesterday announced financial results, reporting a “better-than-anticipated top-line performance, which the company said was helped mainly by higher LME prices.

Alba’s Board proposed to pay a final dividend of Fils 53.14 per share (excluding the treasury shares) totalling BD75.2 million (US$200 million) subject to the approvals of the company’s shareholders at the Annual General Meeting in March 2022.

Top-line was driven in by higher LME prices (44% YoY in Q4 2021 and 45% YoY for the Full-Year of 2021), while the bottom-line for Q4 and Full-Year of 2021 was driven by higher topline and partially impacted by higher Selling and Distribution Expenses.

Quarterly results

Q4 Profit was BD181.2 million (US$481.9 m), up by 466% Year-over-Year (YoY) versus a Profit of BD32 m (US$85.1 m) in the same period in 2020.

Earnings per share were fils 128 for Q4 2021 versus Earnings per Share of fils 23 in the year-ago quarter.

The Total Comprehensive Income stood at BD183 m (US$486.7 m) versus Total Comprehensive Income of 2020 of BD32.9 m (US$87.8 m) – up by 455% YoY.

Gross Profit was BD215.5 m (US$573.1 m) versus BD60.1 m (US$159.8 m) in Q4 2020 – up by 259% YoY.

Alba generated revenues of BD523.3 m (US$1,391.8 m) versus BD278.8 m (US$741.5 m) in Q4 2020 - up by 88% YoY.

Full-year results

Full-year 2021 Profit was BD451.9 m (US$1,202 m), up by 4,532% YoY, versus a Profit of BD9.7 m (US$26 m) for 2020.

Earnings per Share was fils 319 versus EPS of fils 7 in 2020. Alba’s Total Comprehensive Income was BD458.5 m (US$1,219.4 m), up by 30,467% YoY, compared to a Total Comprehensive Income of BD1.45 m (US$3.9 m) for 2020.

Gross Profit for 2021 was BD577 m (US$1,534.6 m) versus BD141 m (US$375 m) in 2020 – up by 309% YoY.

Revenue topped BD1,584.8 m (US$4,214.9 m), up by 49% YoY, compared to BD1,061.4 m (US$2,822.9 m) for 2020.

Chairman of Alba’s Board of Directors, Shaikh Daij Bin Salman Bin Daij Al Khalifa, said, “Our strong finish in 2021 reflect our disciplined approach to go the extra mile and exceed our expectations despite the unprecedented challenges we faced with COVID-19 and logistics.

This better-than-anticipated top-line performance combined with our lean cost mindset allowed us to give back to our shareholders and reduce our overall debt position.

What made 2021 extraordinary is that our Safety performance was behind our all-time productivity – achieving 0 LTIs and more than 20 million safe working hours.”

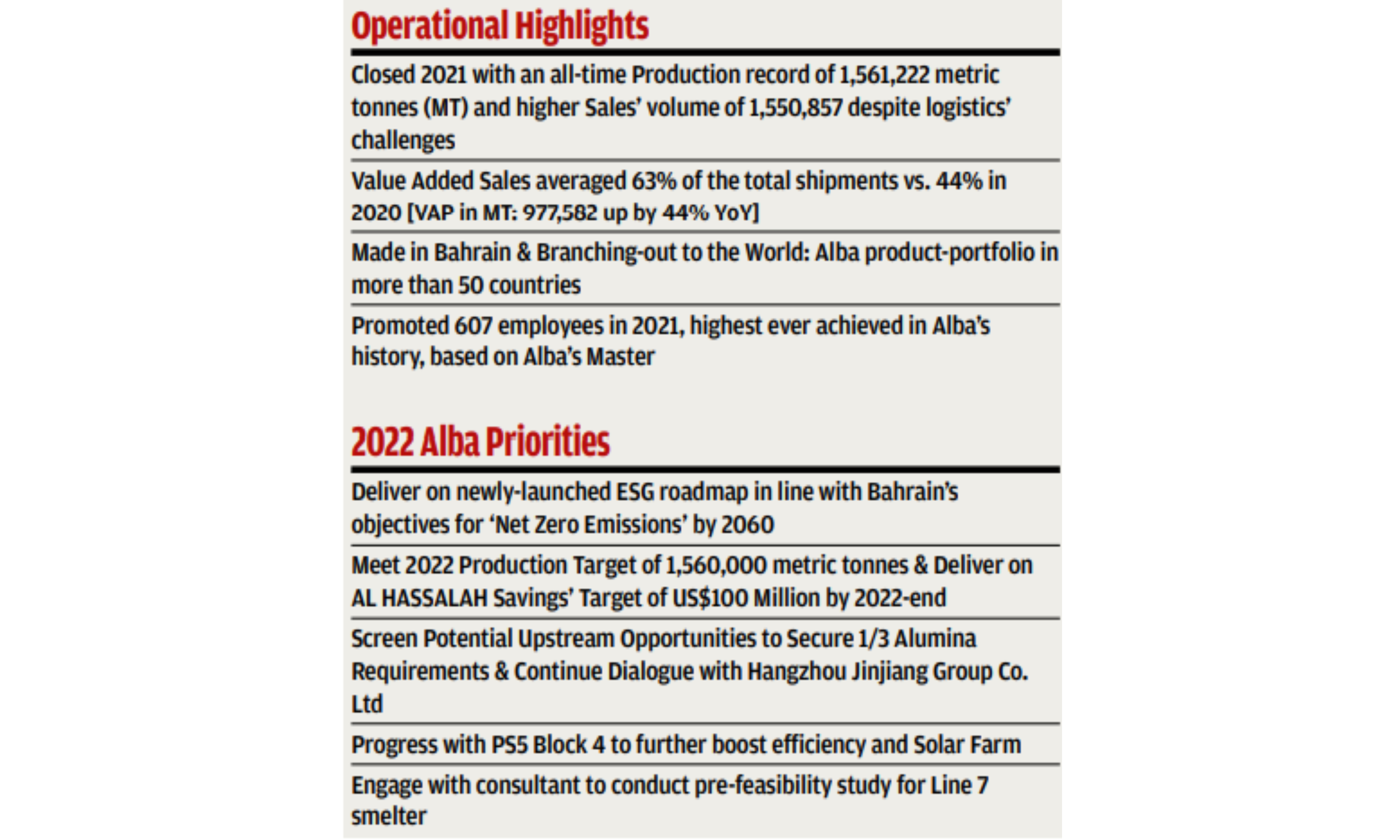

Alba Management will hold a conference call on Monday at 3 PM to discuss its financial and operational performance for Q4 and Full-Year of 2021, outline the Company’s priorities for 2022 as well as provide an update on the current market conditions and outlook for 2022.

Related Posts