NBB nine-month profit rises 11%

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

Higher provisions following the cessation of the loan deferral programme, The National Bank of Bahrain said, has impacted NBB’s third quarter results, producing a 25% drop in quarterly net profit attributable to equity shareholders.

The third quarter net profit attributable to equity shareholders was BHD 11.4 million (USD 30.2 m), compared to BHD 15.3 m (USD 40.6 m) in the year-ago quarter. Basic and diluted earnings per share decreased to 6 fils (USD 2 cents) from 7 fils (USD 2 cents) in the same quarter a year ago. However, Mark-to-market movements of the Bahrain sovereign bond portfolio produced a 9% rise in total comprehensive income attributable to NBB’s equity shareholders to BHD 9.8 m (USD 26.0 m) from BHD 9.0 m (USD 23.9 m) in the prior-year quarter.

Operating income grew 14% to BHD 43.5 m (USD 115.4 m) from BHD 38.2 m (USD 101.3 m) in the prior year period, thanks to higher net interest income resulting from higher loan volumes, and higher income from the Treasury and capital markets activities.

Year-to-date

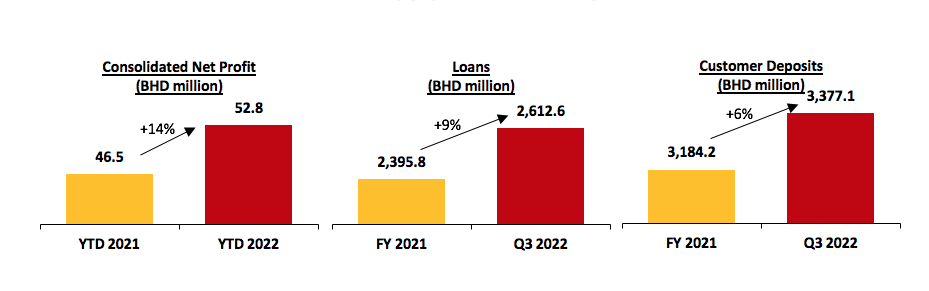

Nine-month net profit attributable to equity shareholders rose 11% to BHD 50.8 m (USD 134.7 m) from BHD 45.8 m (USD 121.5 m) from a year ago. This translates into a 14% growth in consolidated net profit for the Group.

NBB attributed the increase mainly to strong business fundamentals reflected through higher net interest income attributable to higher loan volumes and higher other income from the Treasury and capital markets activities, slightly offset by higher provision requirements compared to the prior year period following the cessation of the loan deferral program.

Basic and diluted earnings per share increased to 25 fils (USD 7 cents) from 22 fils (USD 6 cents) in the same period of 2021. Total comprehensive income attributable to NBB’s equity shareholders jumped 37% to BHD 49.3 m (USD 130.8 m) from BHD 36.1 m (USD 95.8 m) in 2021 helped mark-to-market movements of the Bahrain sovereign bond portfolio and to higher profitability reported in 2022 compared to the same period in 2021.

Operating income rose by 14% to BHD 130.2 m (USD 345.4 m) compared with BHD 114.5 m (USD 303.7 m) for the same period in 2021, thanks to higher interest income from loans and higher income from the Treasury and capital markets activities.

NBB’s Chairman of the Board, Farouk Yousuf Khalil Almoayyed, stated: “This growth highlights NBB’s continued strong business fundamentals. We are also pleased with the various notable non-financial achievements across the quarter.”

NBB’s CEO, Jean-Christophe Durand, said: “We are pleased to announce a 14% growth in the total consolidated net profit during for the nine months ended 30 September 2022 compared to the same period in 2021, along with a rise in the Group’s balance sheet and loans against the year-end levels, which demonstrate continued attraction for NBB’s offerings in this competitive market across both the retail and corporate segments.

Related Posts