Bank ABC shareholders approve US$ 70 million cash dividends

TDT | Manama

The Daily Tribune – www.newsofbahrain.com

Bank ABC, MENA’s leading international bank, held its Annual Ordinary and Extraordinary Meetings yesterday.

The meetings were hosted virtually by the Group Chairman, Saddek Omar El Kaber, and the Group CEO, Sael Al Waary. During the meetings, Shareholders approved the Bank’s consolidated financial statements for the year ended 31 December 2023.

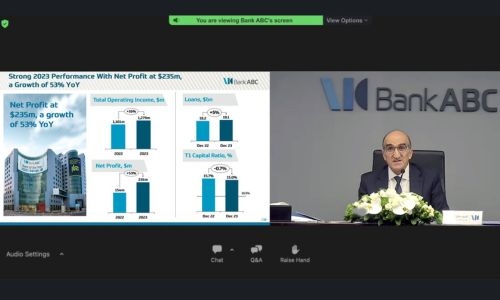

The Bank’s impressive financial results included a number of records in the Group’s history, with revenue at its highest ever level of approx. US$ 1.3bn and assets reaching a record high of almost US$ 44bn.

Alongside this, net profits showed an exceptional 53% YOY growth reaching US$ 235m and RoE improved by over 2% YOY to reach 5.8%. The Board’s recommendation for the appropriation of profits for the financial year ended 31 December 2023, was approved by Shareholders as follows:

• Cash payment of a 2.25% dividend of US$ 2.25 cents for each outstanding share (net of treasury shares) for approximately US$ 70 million, a 50% year-on-year increase (2022 dividend of US$1.5 cents per share).

• Transfer of US$ 23.5 million to the legal reserve.

• Transfer of the remaining balance of approximately US$ 142.3 million to the retained earnings. Additionally, Shareholders approved a prospective AT1 issuance of up to US$ 400m, which will further support the Group’s accelerated earnings and growth strategy while maintaining the emphasis on balance sheet strength with robust capital ratios.

Bank ABC Group Chairman, Saddek Omar El Kaber, remarked: “The strength of our financial performance affirms that the Group’s strategy is delivering on its intent to create greater value for our shareholders, illustrated by the 50% increase in dividends amounting to US$ 70 million. Supported by disciplined governance, the Group is well positioned to continue a trajectory of fast paced profit growth, while maintaining its strong balance sheet.”

Group CEO, Sael Al Waary, added: “The Bank’s exceptional performance, amid challenging geopolitical and economic conditions, is testament to the resilience of our global operations and our commitment to deliver on our aspirations for accelerated earnings growth and increasing returns to our Shareholders in 2024 and beyond.”

Related Posts