Working with Islamic Finance

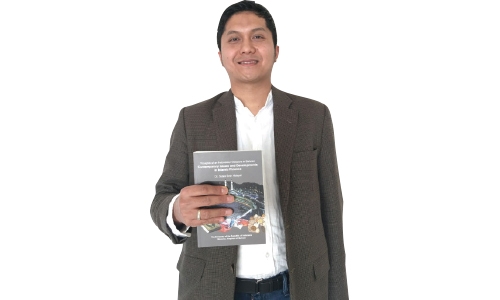

Dr. Sutan Emir Hidayat, Head of Business Administration and Humanities Department, University College of Bahrain, is the author of the book “Contemporary Issues and Developments in Islamic Finance” that has been published by the Indonesian Embassy in Bahrain. In the book published recently Dr. Hidayat contends that Islamic Finance is conducive to poverty alleviation and social justice, important pillars of sustainable development. Here are the excerpts from DT News interview with him.

What distinguishes Islamic finance from mainstream finance?

Islamic finance was created as a result of Muslims’ efforts to dedicate all aspects of their lives to Shariah. Muslims must comply with Shariah in all their activities including their financial transactions. There should be no prohibited elements such as riba, gharar and maysir involved in their financial transactions. Therefore, Islamic financial institutions (IFIs) were established to be Shariah compliant institutions and also to realize the objectives of Shariah.

Has there been a historical evolution of Islamic finance? Are there country or regional variations of Islamic finance?

Yes, the development of Islamic finance can be divided into several phases. In 1960s, the establishment of Tabung Haji in Malaysia and Mit Ghamr Rural bank in Egypt was the first modern experiment of Islamic finance. It is followed by the establishment of several pioneer IFIs mainly in the Middle East such as Dubai Islamic Bank in 1970s. In 1980s, IFIs started to appear in other parts of Muslim world such as Malaysia and Bangladesh. As the number of IFIs increased, there was a need to have infrastructure institutions that act as standard setters for the industry. For example, the accounting and auditing organization for Islamic financial institutions (AAOIFI) was established in 1990s to serve the need. From 2000s onward, Islamic finance almost has covered all aspects of mainstream finance and has existed in both Muslim and non-Muslim countries. However, it is important to note that due to differences in the school of thoughts adopted by Muslim countries, there are differences existing in the application of Islamic finance around the world. However, the differences are narrowing from time to time especially after the release of several universal Standards such as the AAOIFI Shariah standard.

What are the challenges facing Islamic finance?

There are several challenges that need to be tackled to sustain the development of Islamic financial industry such as (1) low public awareness level of Islamic finance principles which leads to misconceptions about Islamic finance itself; (2) Insufficient number of human resources which includes skill mismatch; (3) Lack of liquidity management instruments; and (4) The introduction of new international rules and regulations such as Basel 3 and the IFRS that must be adopted by IFIs in many countries has put IFIs into tougher situation since IFIs must comply with both Shariah and the international rules and regulations.

What is the current size of Islamic finance? How has it grown during the past decade?

The current size of Islamic finance is estimated around USD 1.7 to 2.1 Trillion. In term of market share from the total global financial market, it only represents 1% which is still relatively small. However, it is important to note that the industry has been growing significantly. For example during 2009-2013 the industry’s compound annual growth rate (CAGR) stood at 17% which is considered remarkable.

ln Islamic banking, the responsibilities are shared between the bank and the investors meaning that they both make a loss or a profit, what do you think about this?

It is true that one of the main principles of Islamic banking and finance is “the profit and loss sharing principle”. This principles is fair and fitting the human nature. For example, an English proverb says “No pain no gain”. This proverb can be interpreted as “if you want to gain you must be ready to take the pain”. The profit and loss principle is very much in line with this proverb. On the other hand, in the case of loan with interest, the lender is at the upper hand since his/her principal and return are guaranteed by the contract regardless of the business outcome. So, it is not in line with the proverb.

Islamic banks do not pay out interest but share the profits with their customers and strive towards a more equal distribution of wealth, what do you think about this?

I can say that Islamic finance strive towards a more “equitable” distribution of wealth instead of “equal”. Equitable means fair and justice. Islam accepts inequality in income as long as it happens due to acceptable reasons. However, in Islamic finance, all factors of production namely labor, capital, land and entrepreneur are equally weighted. For example, in a Mudharabah contract, both capital provider and the entrepreneur are equal since both of them are partners. On top of that, there are several mechanisms in Islam that aim to reduce income inequality such as Zakah, Waqf and Sadaqah. These mechanisms are embodied in Islamic finance.

lMany supporters of Islamic banking think that interest free banking is better for the society, do you agree with this? Please explain.

I am in the opinion that if all Islamic finance principles are comprehensively implemented, they will help countries around the world to improve the welfare of the society. Islamic finance will also help those countries to achieve the Sustainable Development Goals as framed by the United Nations in 2030 since Islamic finance promotes financial stability, financial inclusion and shared prosperity which are very much in line with the sustainable development concept.

Islamic banking is seen as a more ethical way of banking, do you think that Western banks should pay more attention to ethical banking and what do you think about the greed culture?

I have heard and read many people that quote Islamic finance in general (including Islamic banking) as a more ethical way of doing financial transactions. For example, at one time Pope Benedict urged the western community to look at the Islamic banking model because of its ethical principles. I also have some non-Muslim students and ex-students at University College of Bahrain (UCB) who are studying or studied Islamic finance. When I asked them why they are interested to study Islamic finance, most of them said that because Islamic finance is more ethical. Regarding the greed culture, this is actually the main problem that we need to curb. The greed culture has no place in Islam and obviously Islamic finance.

Related Posts