Technologically Ahead

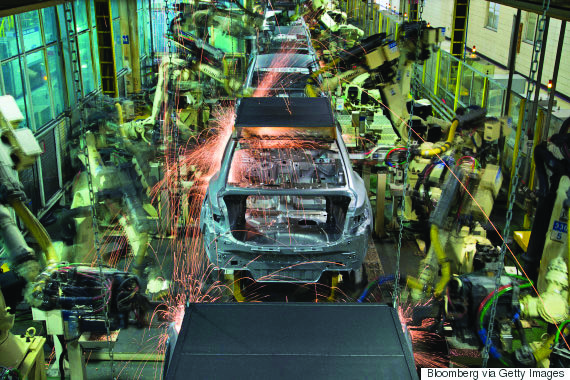

Automation has been responsible for improvements in manufacturing productivity for decades.

Advanced robotics will accelerate this trend. Machines, after all, can perform many manufacturing tasks more efficiently, effectively and consistently than humans, leading to increased output, better quality and less waste. And machines don’t require health insurance, coffee breaks, maternity leave or sleep.

The industrial world realizes this and robot sales have been surging, increasing 29 per cent in 2014 alone, according to the International Federation of Robotics.

Of the more than 229,000 industrial robots sold in 2014 (the most recent statistics available), more than 57,000 were sold to Chinese manufacturers, 29,300 to Japanese companies, 26,200 to companies in the U.S., 24,700 to South Koreans and more than 20,000 to German companies. By comparison, robot sales in India totalled just 2,100, IFR reported.

None of this should surprise us. Automation makes little or no economic sense in countries where there is comparatively little manufacturing or where abundant cheap labour is readily available. The basic economic trade-off between the cost of labour and the cost of automation is the primary consideration. Labour laws, cultural considerations, the availability of capital and the age and skill levels of local workers also are important factors.

Consider an economy such as India’s. When you have 1.3 billion people who can make things cheaply, it doesn’t make a lot of economic sense to automate. In fact, Indians appear more likely to design and produce labour-saving robots and other such machinery than to use it in their factories.

Also important in the “buy” or “don’t buy” calculation involving robotics is the technical ability of machines vis-a-vis manual labour. Some jobs — think textile cutting and stitching, for example — simply need human hands, at least for now. This is good news, all else being equal, not only for China and India, but for other emerging market economies like Bangladesh, Indonesia, Pakistan, Thailand and Turkey, which are significant textile exporters.

But with wages increasing in emerging economies, we soon may see more robotics even in textiles, especially in cotton products where the raw material is shipped to countries like Pakistan, converted to textiles and sent back to the U.S.

What this all means is that the next stage of the robotic revolution — dubbed Industry 4.0 — will affect some countries more than others and some industries and job categories more than others. Every industry has certain unique jobs, each with its own required tasks. Some jobs can be automated, others not. Moreover, different tasks require different robotic functions — some of which will require very expensive robotic systems. All of this has to be considered.

The fast pace of automation in South Korea and Taiwan can be explained in part by higher-than-average wage increases, aging workforces and low unemployment rates. In a developing economy like Indonesia, the motive might be different — to improve quality so local factories can compete with those in Japan and the West.

Other countries that have been rapidly integrating robotics into manufacturing, but not quite as quickly, are Canada, China, Japan, Russia, the U.K. and the U.S. China is an interesting case because it’s automating rapidly despite the fact that Chinese wages are still comparatively low.

The reason for this, we believe, is that Chinese manufacturers see the writing on the wall. Labour costs have been increasing rapidly in China, a trend that is likely to continue. Moreover, with an aging workforce — complicated by the country’s decades-old though recently abandoned one-child policy — skill shortages appear on the horizon. And quality remains a big concern. The strategic use of robots can help compensate for these shortcomings.

Countries moving more slowly in the adoption of industrial robotics include Australia, the Czech Republic, Germany, Mexico and Poland. While there are other factors at play as well, labour regulations that require employers to justify layoffs and pay idled workers for long periods of time appear to be largely responsible for the slower pace.

The slowest adopters of robotic technology among the 25 largest manufacturing exporters have been Austria, Belgium, Brazil, France, India, Italy, the Netherlands, Sweden, Spain and Switzerland. With the exception of India, all of these nations have aging work forces, some of the highest productivity-adjusted labour costs in the world and are likely to face serious skill shortages in coming years.

As the world’s emerging economies industrialize and labour costs rise — as is now happening in China and happened even earlier in South Korea and Taiwan — the picture is likely to change.

For now, however, workers in most developing economies would appear to have little to fear. Robots may be coming to their factories, but not any time soon.

Related Posts