Tips on Acquisitions and Mergers

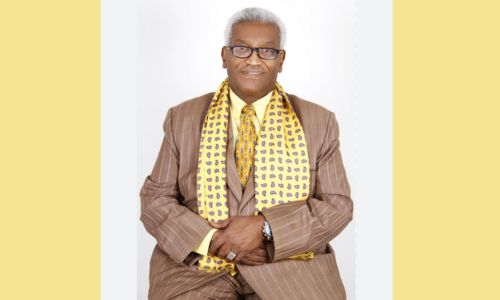

LEGAL VIEWPOINT BY DR. ABDELGADIR WARSAMA GHALIB

As a rule of law, consolidation and amalgamation of companies could take place either by the process of acquisition or otherwise by mergers.

There were good examples to remember for acquisition in Europe in many sectors, as the takeover of Nat west by Royal Bank of Scotland. Other good examples for merger in America, in the media sector, the Time-Warner by American Online.

And many others, took place, as legally approved and without affecting the trading rules governing fair competition. The consolidation by acquisition shall be effective through applying the following formalities:. The company, to take part in consolidation, shall first adopt a resolution that orders its dissolution and accordingly its non-existence as a legal entity. This is required, so as to pave the way for the new company to be incorporated.

The company, to take part in consolidation, shall take all necessary steps for the valuation of its net assets according to the provisions stipulated in the law and to be followed as in cases regarding valuation of shares in kind. In other words, the valuation here is identical to the valuation of shares in kind.

The acquiring company should adopt a resolution for increasing its capital in accordance with the result of the valuation of the acquired company.

That is to say, to increase its capital to absorb the valuation of the newly joining company. The increase in the capital of the acquiring company shall be distributed among the partners shareholders proportionately to their equity shareholding.

This, of course, includes all existing partners shareholders. In case the stocks of the company were represented by shares and two years have expired from the incorporation of the acquiring company, these shares could be negotiated immediately after their issue.

A number of shares or stocks shall be allocated to each consolidating / amalgamating company equal to its share in the capital of the new company. These shares shall be distributed between partners shareholders in each of the consolidating / amalgamating companies proportionately to their own shares.

There are certain legal procedures that should be followed before the intended consolidation takes place. Such as, the consolidation becomes effective only after three months from the date of registration in the CR.

The concerned companies in consultation with the competent authorities, shall publish notice in newspapers informing the public about the consolidation. This is, to give any one the right to come forward and give objections, if any? Creditors of the consolidated company may, within the period, give their objection to the consolidation.

In such instances the consolidation process shall be suspended unless the creditor(s) waives their objection.

The court, could overrule the objections from any creditor or otherwise the company should settle the debt if it was due, or it should provide sufficient guarantees for the settlement of such debts, provided that the creditors accept such arrangement.

In case any person does not appear in time to present an objection, during the specified period, the consolidation shall be considered final and the new company shall legally replace the non-existing companies in rights & liabilities.

Suppose someone appears after the specified time, I think this should not affect the validity of the consolidation, however, the new management should settle the issues raised by him.

Normally the consolidation process takes time and the concerned companies should discuss in details matters regarding the goodwill of each company, issues related to assets and liabilities of each company, the new business name logo for the new company and the names of persons to manage the new company.

All such issues should be discussed in details and agreed upon before the final declaration of the “new” consolidation, the new company

DR. ABDELGADIR WARSAMA GHALIB, LEGAL COUNSEL

Related Posts